by Chris Williams | Feb 9, 2022 | Blog, Leadership

The first pillar of building a resilient business is having a clear Strategy as defined in your mission, vision, and values. While you can have a stellar vision and business model, they are essentially worthless without the right people to come alongside you to make that vision a reality. Which brings us to the second pillar: People.

right people to come alongside you to make that vision a reality. Which brings us to the second pillar: People.

In his book “Good to Great,” Jim Collins compares his “who before what” concept to a bus. He asserts that the most successful, resilient businesses ensure they have the right people on the bus before figuring out where to drive it.

He writes, “The good-to-great leaders understood three simple truths. First, if you begin with ‘who,’ rather than ‘what,’ you can more easily adapt to a changing world…second, if you have the right people on the bus, the problem of how to motivate and manage people largely goes away…third, if you have the wrong people, it doesn’t matter whether you discover the right direction; you still won’t have a great company.”

Attracting and retaining the right people, however, is more complex today than in years past. A recent article in Fortune magazine reports a record-breaking rise in the rate of employees leaving their jobs in recent months, with 4.5 million quitting in November 2021 alone.

Disruptions and obstacles presented by a global pandemic play a big part in the phenomena of the “Great Resignation,” – but there’s more to the story.

Attract With Your Mission, Vision, and Values

A careful look at Google’s Year in Search 2021 Report reveals several insights into what is increasingly important to the workforce in 2022.

“Mental health” and “sustainability” were terms searched at record highs last year. “When is Juneteenth” and “pride events near me” were questions searched more than ever in the U.S. for the second year in a row.

These insights reveal that employees today are looking for more than just pay scales and flexible working options. More than ever before, employees want to work for businesses that care deeply about the health and well-being of their people. They want to work for companies that value diversity, equity, and inclusion; they want to work for organizations that are good stewards of our environment and planet.

Can you effectively articulate your vision and values around these and similar concerns when trying to attract employees? Are you thoughtfully incorporating them into your job listings, applications, and interview conversations? These are things to consider as you work to attract employees who are as invested in your “why” as you are.

Thoughtful Applicant Screening

Screening resumes to find the best talent for your business can be overwhelming, but there are strategies and tools you can implement to make sure the best candidates rise to the top of your list.

Don’t skip putting intentionality and thought into your job applications. It’s the first impression your applicants will receive of you, and it’s a great way to glean critical insights that can make your screening process easier and time-efficient.

Including strategically subtle questions on your applications is a way to engage the people applying for the job and screen out who is and who is not paying close enough attention.

From the get-go, an engaging, thoughtful application will expose the range of communication and detail skills of the people applying to work for you. This can be as simple as a fun question like “what’s your favorite color” to a more introspective question that engages what’s most meaningful to your applicants. Figure out what attributes are most vital to your company and find creative ways to pull that information out of your applicants from the very beginning.

Many companies will send applicants a take-home aptitude test to make sure their skills match the needs of your business. While this might seem to save you time, don’t underestimate the value of sitting down one-to-one with applicants to work on practical problems. Job shadowing gives you more precise insights into the applicant’s aptitude, personality, and communication strengths.

As your business grows, contracting an outsourced hiring company to help screen resumes can be an excellent investment, so long as you make sure to carefully and thoroughly interview those candidates whose resumes rise to the top. Outsourced recruitment can be immensely helpful for companies taking in large volumes of resumes and applications, but they won’t prioritize your vision and values as intentionally as you.

Your Business’ Most Important Asset

People are complex, and their values and needs are evolving as rapidly as our world, but people are ultimately your greatest asset. It is well worth the time and care required to ensure you have the right people on your bus before setting off for your destination.

By leading, attracting, and interviewing with your vision and values front and center, you will be laying the foundation of a resilient business that can weather the disruptions and changes of the future. Once you have found the people you want on your team, the next trick is retaining them. Join us next time as we unpack how to foster and invest in a culture that will keep employees for years to come.

by Chris Williams | Jan 25, 2022 | Blog, Leadership

This past week, BlackRock CEO Larry Fink released his annual letter to investors. As a leader of one of the largest global investment firms, his words are powerful, poignant, and directive.

He wrote, “It’s never been more essential for CEOs to have a consistent voice, a clear purpose, a coherent strategy, and a long-term view. Your company’s purpose is its north star in this tumultuous environment.”

A resilient business is a successful business. A resilient business is a profitable business. A resilient business adds value and is valued by its stakeholders. A resilient business knows why it exists.

When it comes to business strategies, you have countless books and experts to choose from, covering all manner of topics. There is one strategy, however, that applies to any business, whether you are in the startup stage or are already an established company. That strategy is a well-crafted, written mission statement that clearly articulates your business’ mission, vision, and values.

Don’t be fooled into thinking it sounds too simple to carry so much weight. A well-written mission statement that encompasses who you are and where you are going provides a solid, resilient foundation from which to grow and work. It allows you to weather unexpected, tumultuous years with rooted security and unified vision.

So, what makes a great mission statement? And how do you go about creating one?

Here are 4 steps to crafting a foundational mission statement.

1. Check out the mission statements from companies you admire.

It’s likely that the companies you admire most already have really great mission statements.

Understandably, it can feel overwhelming to take stock of all your business ideas and develop a concise, clear answer to the “why” behind it all. If you feel hesitant or just stuck in this area, it can be constructive to take a close look at the companies you admire and would like to emulate.

Study their mission statements and identify what questions they are answering. Can you distill their mission, vision, and values from their credos? What resonates with your company? What doesn’t? What words and phrases invigorate and inspire you?

A great mission statement will clearly answer the questions of what your mission is, what your vision is, and what your core values are.

If you respect and admire a company, you’ll likely align with its mission, vision, and values as well. Take time to research the statements of these companies for inspiration.

2. Get away with your team.

It’s not uncommon for professional writers to retreat from the distractions and familiarity of their home and office when they need to get an important project finished. Even if writing isn’t part of your profession, we believe that taking that same kind of intentionality when creating your business’ mission statement can be immensely helpful.

Consider taking your team on a “writer’s retreat.” Getting out of the office and into an environment of quiet and rest can provide the right kind of setting to get your team’s collaborative, creative juices flowing.

Ask your team questions like “where are we going?” “What values are most important to us?” “What mission are we trying to accomplish?” Getting away from your day-to-day environment provides the mental breathing room to dig into these more profound questions.

Don’t forget to take thorough notes because these conversations will form the foundation for your mission statement.

3. Rework, refine, and write it down.

There’s a big difference between having your great ideas articulated in your head and actually writing them down.

The process of writing forces you to wrestle with and fine-tune your ideas into their most essential, easily understood forms. Like a sculptor who chisels away at all unnecessary stone until the final sculpture emerges, editing helps you chip away all the excess thoughts and words until you are left with the purest, most clearly defined ideas you want to convey.

This is a process that can’t be rushed. It will take time, intentionality, and, most likely, many re-workings to get just right. It is easy to pile words around a concept; brevity is always the challenge.

This process is not a “one-and-done” practice, however. Plan to regularly visit your statements to ensure you stay true to your mission and values.

4. Infuse your mission statement into your business practices.

Once you’ve got your mission statement written down, it should become your business’ “north star” to follow. Your mission statement should be what you and your team turn to when questions or disruptions inevitably arise. Your mission statement should also attract your customers and future employees.

As an example, one of SSB’s core values has always been the tried and true golden rule: “do unto others as you would have them do unto you.” This value has acted as our north star since our startup season around a kitchen table in Seattle. To this day, it is still a value that we check ourselves by as we work to grow, attract customers, retain employees, and create a rewarding workplace culture.

If we are missing the mark with a core value, we know we are not on track with our company’s mission. Instilling these values in your business will require frequent, habitual integration into your rhythms. Talk about them in leadership gatherings, include them in onboarding procedures and employee onboarding, review them in team meetings. If they only live as an aside on your website, they won’t infiltrate your company’s culture.

As you consider strategies to help grow your business from startup to success in 2022, we can’t encourage you strongly enough to prioritize a well-crafted mission statement. It may sound like a simple strategy, but we guarantee every hour of intention and work you put into clearly defining your mission, vision, and values will pay dividends as you endeavor to build your resilient business.

by Chris Williams | Jan 11, 2022 | Blog, Leadership

Whether you’re a brand new start-up, still dreaming and working from your kitchen table, or a more established, multi-million-dollar company with years of experience under your belt, resiliency is a quality you need to grow a successful business.

The Merriam-Webster Dictionary defines resilience as the ability to recover from or adjust easily to misfortune or change. Misfortune and change are apt words for the challenges every business will face (if they haven’t yet already in just the last two years alone.)

The bottom line: resiliency is more important than ever as we enter the unknowns of 2022.

We believe a resilient business is one that can stand the tests of time, change, and adversity. It’s building up from a strong foundation that anchors and lends stability in a constantly evolving world that presents unexpected challenges. A resilient foundation is necessary for successful, long-term growth.

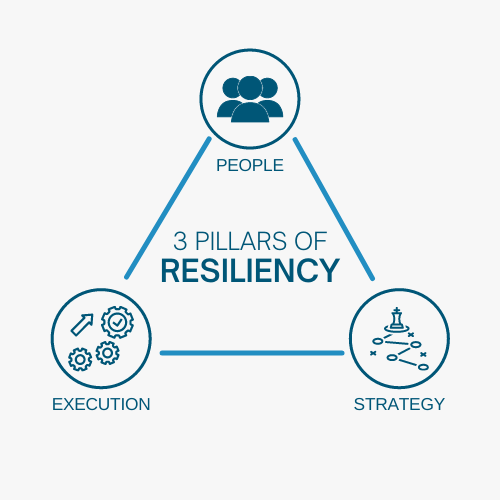

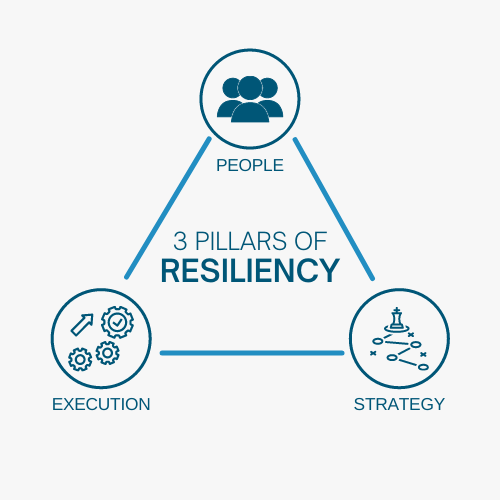

At System Six Bookkeeping, we’ve been both the start-up working around a kitchen table and the multi-million dollar company. As we look back on our thirteen years of growth, we’ve identified three pillars that continue to move us from start-up to success: strategy, people, and execution.

Strategy

There are countless books on countless strategies to consider when creating a successful business. Those strategies are worth exploring and implementing to help meet specific goals. Still, when we’re thinking about long-term resiliency, mission, vision, and values – specifically, the ability to clearly define them and keep them at the forefront of your company’s priorities – will be the most important strategies of all.

We all need a north star to follow, whether we are in the dreaming stage of building our business or are already leading a large, successful company. Don’t underestimate the value of being able to clearly define your business’ mission statement. It will support your vision of where you want to go and shape the values that you want your company to embody.

People

You can have the most inspiring, brilliantly worded mission statement in the world, and it will be 100% useless without people to live it out.

In order to build a resilient business, you need to attract and retain great people who are as passionate about your mission, vision, and values as you are.

There’s no denying that the workforce is rapidly changing. Twenty million employees quit their jobs in the second half 2021 alone. (Source: cbsnews.com) There are layers of factors for this, of course, but employee stress and burnout are high up on the list. Employers face the unprecedented double-challenge of trying to retain their employees and hire in an increasingly competitive environment.

People are your company’s greatest asset. One of the core values we at SSB strive to live by is to do unto others as you would have them do unto you. What do employees most value in today’s evolving culture? What do they need to feel valued and to be successful? It’s never been more important to consider these questions. In fact, Forbes claims that culture is a company’s single most powerful advantage. It not only has the power to increase sales exponentially (4x!), but fosters an environment to keep talented, committed employees that created this growth.

Execution

You’ve got your mission statement nailed down and amazing people to live it out with you – now, how do you go about getting the work done?

We believe resilient businesses have smart, efficient processes to keep communication and productivity consistent and well-organized. Your core values, as well as your desire for the well-being and success of your people, should be evident in the way you implement tools and processes that set you and your employees up for success.

There are many tools and services available to make this easier in 2022 – is your business up to date on the latest tools and technologies to take your productivity and organization to the next level?

Over the next couple of months, we are going to be taking a closer look at each of these pillars of strategy, people, and execution, and deep-dive into why we believe each of them is vital to building a resilient, successful business.

by Dev | Dec 14, 2021 | Blog

It’s a fact that close to a third of annual charitable giving happens in December and that nearly 12% of all giving happens in the last three days of the year.

(Source: neonone.com.)

December is THE month for charitable giving. As we enter the height of the holiday season, now is the time to create a plan for how your business will give back.

Why should charitable giving be a priority as your organization or business prepares for the year’s end? Here are a few considerations as you plan to give charitably this holiday season.

Tax Benefits

It might seem like a self-serving motivation for giving back, but the truth is that tax deductions are a huge incentive for businesses to give charitably.

You may not know that not all donations to nonprofit organizations and charities are eligible as deductions. To claim a charitable deduction, you must give to a qualified charity. Handily, the IRS has an online search engine specifically for checking this.

If claiming a charitable deduction is crucial to you as you donate this year, make sure to research your nonprofit of choice to ensure they meet the IRS’ requirements to be a qualified charity. Meanwhile, make sure you read and understand the IRS’ specific rules concerning charitable deductions.

Don’t forget that qualified donations dated before the end of this year still count for a deduction, even if the funds aren’t scheduled to be released until the new year!

Research, Research, Research

It’s important that you do ample research on any organization you plan to support to ensure alignment with your business’ values.

We recommend researching further than just reading an organization’s mission statement or articles about its activity. It has, unfortunately, become much too easy these days for scammers to hide behind professional-looking marketing and websites. Protect your reputation and your financial contributions, and dig deep into the values and history of the nonprofits you would like to support.

There are specific organizations that can help you do just that. Websites like GiveWell and Charity Navigator keep track of and even rank nonprofits and charities based on factors like transparency and accountability.

Connecting Meaning To Your Work

It might sound cliche, but there is solid evidence to show that giving usually benefits the giver more than the recipient.

As Simon Sinek said, “When we help ourselves, we find moments of happiness. When we help others, we find lasting fulfillment.”

Don’t underestimate the value that charitable giving can give your business and the people who work for you. Giving back is a way for you and your employees to feel connected to something meaningful. This can enrich your work environment and give those who work for you another way to feel invested in your organization and the work you do.

It’s especially true when you choose to give back to organizations doing good work within your own community. When you’ve established a giving relationship with local charities and nonprofits, it can be enormously fulfilling to see your business’ contributions at work for good within your neighborhood.

Whether your business chooses to partner with a global nonprofit or a small, local charity this season, giving back is a value worth prioritizing.

by Dev | Dec 9, 2021 | Blog, Bookkeeping Best Practices

A good fourth quarter just might be the most important win of your business year, because it demonstrates that you know how to implement the right strategies to succeed when and where it counts.

Reviewing this year’s financial records, as well as the goals you made at the start of the year, is a great place to begin gathering the information you need to build the right strategy for the end of the fourth quarter.

Do you hope to show profitability or growth? Do you have investors or stakeholders who are expecting you to hit certain metrics? Did you have a challenging first quarter and do you want to balance it with a big final quarter, or do you want to save those sales for a strong Q1 in 2022? What insights can you pull out of the past year to strategize setting new goals next year? Depending on your situation, here are our tips for making the most of your final weeks of the year.

No matter your situation, there are a few things you should double check and remember.

- If you have a single member LLC but have elected as an S corp, make sure to check with your CPA to make sure you have taken the appropriate salary for the year. If not, you can still change your salary over the next few weeks as needed.

- The holidays is a great time to be generous:

- If you are in the position to do, charitable donations can make a big difference in your community, and they will reduce your taxable income, helping reduce the tax bill you’ll have to pay come April

- Also, it can be a great time to be generous with your team. Whether $50 or $500, a holiday bonus can go a long way to keep your team happy, especially critical in this competitive labor market. But, remember, you must record these bonuses or gifts as income as part of your payroll system. Christmas gifts mean withholding taxes for both the employee and employer – so make sure you pay these through your payroll system, and not via cash!

Strategies for when you’re ending the year with strong profits.

So, you’ve had a great year, and your profits reflect it. What strategies can you implement to reduce potential liabilities and secure conservative metrics before the next tax season?

Take the time to go back through your books and make sure you’ve taken advantage of tax-deductible expenses throughout the year. This is where detailed bookkeeping and implementing accounting technology throughout the year will pay off. Make sure you haven’t missed any valuable write-offs!

If you’ve accounted for all your tax write-offs, this may be the perfect time to purchase new equipment or restock inventory. Significant expenses will reduce your overall taxable income for the year, giving you much-needed new equipment or increased inventory, and importantly, relief on your forthcoming tax bill. Don’t buy equipment just to reduce your taxable income, however – these purchases should be purchases you are going to take on, regardless of timing. But, if you are going to spend the money, spending it in December 2021 vs. January 2022 means you’ll help reduce taxes you must pay come April 2022.

On the flip side, if you are experiencing high demand from your customers in this final quarter, can you defer some of that demand into Q1 2022? Having those customers purchase in Q1 2022 will help reduce your 2021 tax liabilities by reducing your income in 2021. Of course, you’ll still pay income tax on those sales, but by having a customer purchase occur in January 2022, vs. December 2021, you don’t owe Federal Income tax until April 2023 for that sale vs. April 2022 if that sale had occurred just a few weeks earlier in December.

Of course, pulling forward expenses and pushing out demand also impacts what your 2021 P&L looks like. So make sure your actions aren’t going to cause you to miss important revenue or profit goals.

Strategies for when you’re ending the year behind in profits.

What if you’ve reached the fourth quarter and your profit/loss balances don’t match the goals you set for your business at the beginning of the year? What strategies can you implement in the remaining weeks of this year to bring your profits up?

Before panicking, start by critically evaluating your annual numbers. How does this year’s fourth-quarter profit and loss statement compare with last year’s? How much more do you need to earn to meet your goals before the new year? Were the goals you set maybe unrealistic?

Once you have concrete numbers to work with, you can strategize ways to bring up your fourth-quarter profits much more efficiently.

Obviously, how you bring up profits at the end of the year will differ widely depending on the type of business you have, but some helpful questions to consider may be:

- Are there unsold customers from earlier in the year you can follow back up with?

- Are there ways to improve or change up your marketing strategies this holiday season? Would a sale drive a big increase in volume?

- Do you have any stock surplus that you can strategically market and sell?

- Are their proposals in the pipeline that you can push through before the end of the year?

Don’t forget to use the information you gather during this time to help you set the appropriate goals for the coming year. Take a moment to recognize sales trends in your industry, particularly if you have historically strong months or quarters. This can help you balance your annual budget and build sales strategies accordingly.

We may only have a handful of weeks left this year, but there are a lot of things you can do in a relatively short amount of time to finish this year well. Do you have questions about getting a fourth-quarter strategy in place? We can help.

by Dev | Nov 24, 2021 | Blog, Bookkeeping Best Practices

Businesses employ independent contractors all the time, in multiple capacities. Perhaps you hired a freelance designer to create marketing materials for your business this year, or maybe you brought in an independent consultant to develop strategies to improve your operations. If you used a contractor or vendor this year and paid them $600 or more, you need to be prepared to issue them a 1099 tax form by January 31.

1099’s can be complicated and confusing, dreaded by employers and contractors alike. Even if you have experience with issuing or filing 1099s, you may have missed recent changes in tax laws that might affect you this year. Unfortunately, the consequences of failing to use 1099s properly can include fines and penalties, so understanding these complexities is essential. Here are some steps and considerations to keep in mind as you, the employer, prepare for the end of the year.

The first step is to figure out which 1099 form your contractor will need. As of 2021, there are 20 varieties of 1099 forms, but the 1099-NEC (non-employment compensation) form and 1099-MISC form historically have been the ones most commonly used for contract employees who were paid $600 or more during the year.

Use the Proper 1099 Form

Why is this important to know? Until 2020, the 1099-MISC form was used to report payments to independent contractors and vendors for services rendered, but differing due dates created loopholes in the system that were being abused. As a result, beginning in 2021, the 1099-NEC was reinstated to report all payments to non-employed individuals. This covers nearly all contract/freelance work, with a few rare exceptions that may still require a 1099-MISC form.

Always consult a tax professional if you have any questions or uncertainties about which 1099 form you need to issue to your particular contractors and vendors.

Accurate Compensation Records

The next step is to ensure you have all the information needed before issuing 1099 forms to your contractors. Some important questions to consider are, do you have an accurate account of which contractors and/or vendors you used this year, and how much you paid each of them? Implementing a system at the beginning of the year to keep an accurate account of who you are contracting and how much you are paying them will keep you organized and on track when it comes time to issue 1099 forms.

Update Contact Information

Do you have up-to-date and accurate ways of contacting them? Sometimes contractors and vendors move locations or change their contact information. Fall is the perfect time to start making sure you have their up-to-date details, so your 1099 forms get to where they need to be on time (keep in mind that January 31 is the deadline for mailing 1099s to most taxpayers.)

This feels like the right time to re-emphasize the importance of implementing a system and process to keep an accurate account of all these details as early as possible. In today’s paperless, digitalized world, we love software like GUSTO that has digital payroll options for managing your contract employees Additionally, we use Track 1099 when it comes time to e-file on behalf of clients. Still, whether you choose to use the latest software or hire outside professional accounting help, the most important thing is that you have a process in place to ensure you don’t forget about your contract employees and vendors.

At System Six, we pride ourselves on staying up to date with the latest tools and technologies to help clients keep their books clean and organized all year long, setting them up for success during tax season and beyond. So, we focused year round on 1099s (collecting vendor information throughout the year, for example), but now that it’s approaching year end, it’s your turn as well to prioritize 1099s!

Does the process of preparing to issue 1099s to your contracted employees confuse or frustrate you? Are you feeling overwhelmed about your 1099s? We’d love to chat. Please reach out.

Page 2 of 6«12345...»Last »

right people to come alongside you to make that vision a reality. Which brings us to the second pillar: People.

right people to come alongside you to make that vision a reality. Which brings us to the second pillar: People.