by Chris Williams | Oct 13, 2020 | Blog, Bookkeeping Best Practices, Leadership

As Benjamin Franklin once said, “By failing to prepare, you are preparing to fail.” So, let’s prepare now for your future success with a strong budget.

For business owners, having a budget for the New Year is an important part of financial preparation. But for some business owners, just the thought of having to prepare a budget makes them anxious. The idea of adding another item to your to-do list might actually push you over the edge, especially this year. Or maybe you just don’t know where to start. Either way, a budget is a critical step to your success, so reach out! System Six, your current bookkeeper or your CFO can help!

The budgeting process allows business owners to think about how much they will earn and how much they will spend in the following year. It can be as detailed or as summarized as you like. The goal is that a budget will ultimately help the business owner throughout the year determine if the business is on track financially through the use of budget versus actual reporting. So you’ll know month by month when and where to make expense changes or where you may be exceeding your revenue expectations.

Where Do I Start with a Budget?

Preparing a budget may sound like an impossible task. Keep in mind that this process can be as simple as you want it to be the first year and then revised and improved upon in subsequent years.

The most effective way to build your budget is to align your data with the accounts in your financial system (i.e., QBO, Xero, Sage, etc.) and ultimately to input the budget into your system for easy reporting next year. At System Six, we are here to work with our clients and other business owners to help them through this process.

Whether you have prepared a budget before or not, one of the best places to start is by reviewing financial statements for the current and prior two years, making notes on some key pieces of information.

- Do you notice any revenue trends? Are there certain months where you earn most of your revenue each year? Do you see a rather steady revenue increase each month?

- Are there any atypical income sources in those years that may not recur next year?

- Are your Cost of Goods typically a certain percentage of your revenue each month? Are there ever variations in certain months that need to be planned for?

- Are there any atypical expenses in those years that may not recur next year?

- Are there amounts you want categorized differently on your statements next year?

What’s the Point of a Budget?

Building your budget will vary some depending on your revenue model. However, in most cases, when determining your revenue budget, you will want to include realistic stretch goals. A budget needs to be achievable. There are other business growth documents you can use to evaluate and incentivize a sales team, for example, but a budget should be a realistic expectation of next year’s financial statements taking into account known external factors and changes. The expectation is that you will be able to run budget versus actual reports next year and be able to determine if your business is on track to your anticipated (budgeted) bottom line. If you are, great job! If not, you’ll be able to see where the business has gone astray and make real-time (monthly) adjustments to get back on course towards your initial plan.

How Detailed Should My Budget Be?

If this is your first time preparing a budget, our recommendation is to keep it simple! We don’t want you to feel like your budget is more trouble than it’s worth. If you are a Budgeting Pro, you can make your budget as detailed as you like. Either way, you will want to match your budget data to the Chart of Accounts inside your Financial System (i.e., QBO, Xero, etc).

You can enter your revenue to the top level called Revenue/Income or you can split it between your various sub-Revenue accounts. The same is true for all layers within your Chart of Accounts, including Cost of Goods and Expenses, being as detailed as you like or simply entering to the parent/summary/header accounts that you prefer. You can even choose to simply enter annual amounts for all accounts which will auto-split evenly across all 12 months of the year. Just a quick note that if you enter budget entries to the Summary accounts, and then next year actual expenses are entered to Sub-Accounts (more detailed), you will want to run Summarized Budget versus Actual reports in order to see the variances at the Summary level. But don’t worry, this is just fine; your budgeting efforts are still well worth the time! You may find this is all you need for several years.

At this step in the process, having reviewed both current year and prior year financial statements, it is up to you to determine next year’s annual budgeted revenue. An estimate is fine at this point based on what you know about your business. It is helpful to forecast where you think your revenue will be at the end of the current year in order to have a solid starting point for next year’s budget.

How Do I Determine Budgeted Revenue?

You may be wondering how you calculate more detailed budgeted revenue. This will differ depending on the type of business you operate.

Different Types of Businesses

- Subscription or Donor/Membership-Based organizations typically track their subscribers or donors/members by level or group and price. They know how many members they anticipate for next year and what revenue that equates to.

- Service or Project-Based organizations typically track their services by price. They anticipate a certain number of services for next year and what revenue that equates to.

- Inventory/Product sales organizations typically track their product sales by product. They anticipate a certain number of product sales for next year and what revenue that equates to.

These calculations are made with information pulled from a Point of Sale system or Membership database, which may or may not be directly integrated with the financial system.

More Complex Business Structures

What if your financial system is set up with even more detail, such as departments, locations or class structure? All of these layers can absolutely be taken into account when creating your budget. Essentially the process is the same; you will simply repeat the process for each of these layers. In the end, when the budget is entered into your financial system for each of those layers, the summarized version of your budget will “roll up” to your master budget. It is important to note that completing a budget process to this level of detail can be quite time consuming, especially if this is new to you or if you are taking on this challenge alone without any supporting departmental staff.

Special Revenue Considerations

As revenue is estimated for next year, it is important to include potential key business changes, such as new product lines/products or expanding business areas. Conversely, it’s also important to consider the discontinuation of any business lines/products or the closure of any business areas. Other key changes might include the impact of price increases, including not only the anticipated increase, but also any customer impact as a result of those increases (i.e., cancellations, etc.).

What’s Next?

Once you have this detailed annual budgeted revenue, the next step is to determine how to spread it out monthly for next year’s budget. If you have chosen not to calculate annual revenue in such detail, simply use the annual budgeted revenue for the business as a whole you determined above.

Monthly Revenue Modeling

Once you know what you are expecting for next year’s annual revenue, it’s important to know how to spread out that revenue each month. Depending on the type of business you operate, there are several options to choose from. Please note that if your revenue is consistent month to month, you can choose to enter your annual revenue, skipping this step altogether, allowing the system to allocate revenue evenly by month (simply dividing by 12).

Cyclical Revenue Modeling

Does your business generate most of its revenue during a specific month or quarter of the year? For example, is your business dependent on New Year’s resolutions (i.e., gym memberships, etc)? Or, is your business dependent on holiday sales (busiest from Oct-Dec)? If so, then your business would be considered cyclical, with more revenue being entered to specific months during the year. For a cyclical business, it is important to budget revenue next year by looking at the historical trends for those key months, being realistic about growth, and then allocating revenue in the other months similarly.

Incremental (or Percentage Growth) Revenue Modeling

Does your business typically grow a certain percentage each year or each month? If so, calculate the growth percentage and see if that applies consistently throughout the year or in certain quarters. Based on what you find, this percentage growth should be applied similarly to revenue amounts for next year.

Breakeven Revenue Modeling

Would you like to budget revenue based on the minimum amount needed to cover anticipated expenses for next year? This is called Breakeven Budgeting. You can apply revenue Cyclically or Incrementally, but by lower amounts or even reducing revenue from the current year. In this model, first budget expenses, budgeting revenue last, with the goal being a $0 Net Profit/Bottom Line. The purpose of this model allows business owners to know that if they do not exceed budgeted expenses and at least meet budgeted revenue, they will not lose money at year end.

Expense Modeling

The expense side of the budget model typically uses percentage growth for key accounts. Most often, business owners will review current and prior year financial statements to gauge expense levels and increases year over year to estimate next year’s budget. Key areas to consider include:

- Cost of Goods Sold: Since these are industry or even business specific, you’ll want to review these in depth to determine what to expect for next year by month.

- Payroll: You’ll want to consider both cost of living increases as well as any anticipated performance increases. Keep in mind that payroll accounts can be in various places within the Chart of Accounts, depending on your layout, including Costs of Goods Sold and Admin/G&A, and may also split out owner wages separately.

- Employee Benefits: Benefits can unexpectedly increase, sometimes quite a bit year over year, so it can be helpful to reach out to your broker to get an idea of your increase for next year. Be sure to include any new benefits you may be implementing next. And similar to Payroll, these costs may also be found in several places on the P&L, including Cost of Goods Sold and Admin/G&A, with owner benefits oftentimes split out separately.

- Utility Increases: Although often considered a “fixed expense”, utility companies do increase their rates and utility expenses can be a large expense on the books. So taking a look at prior year increases can help determine next year’s budgeted expense.

- Revenue-based taxes: Depending on your state, revenue-based taxes are typically percentage based. So for budget purposes, setting them as the same percentage (of next year’s estimated revenue) as current year is generally a safe bet, unless you expect major changes to your business model.

- Other expenses: As the business owner it is important to look at the other expenses on your books, determine what percentage increases are appropriate for next year or if there is another methodology that makes more sense for estimating next year’s budgeted amount. You know your business best and are in the best position to make those estimates.

So Where Do YOU Want to Start?

Having reviewed more about what you already knew or learned something new, where do you want to start with this important step towards your 2022 success?

How Can We Help?

If you are interested in some help with this project, please click on this link and connect with us at System Six. It will take you to a short list of questionnaires to help us determine how we can best serve you in this process.

by Dev | Oct 9, 2020 | Blog, Leadership, Resources & Downloads

We’ve all had to pivot this year in order to keep ourselves and our communities safe. While some companies, like System Six, have been working remotely for years, we recognize that the shift to completely digital platforms and processes can be overwhelming and daunting. The good news is that there are so many great options for online tools that will have your team working cohesively in no time. We know that nothing can quite replace the collaborative vibes of your office or the chit chat around the water cooler, but hopefully these tools will help you get on the same page while you can’t be in the same space.

We use Teams (and have used Slack in the past) primarily as a means to field casual conversation and quick questions. In order for this to work to its full potential, though, you have to have strong buy-in from your team and commit to quick response times together so that it remains an effective means of communication. Teams can be used for questions and updates that can be handled quickly and easily; it’s not for asking particularly heavy questions that require your colleague to completely stop what they are doing to help. Make sure to ask specific questions and avoid ambiguity.

Karbon | Detailed task management

Karbon is our preferred tool for task management. It is a tool that is specifically built for accounting firms but we’d highly recommend a tool like this (see Teamwork, Clickup, or Asana) for keeping track of tasks. Email is not an ideal place to assign tasks because once the email has been sent there is no visibility of if/when the task got done and no way to see if the task is still in process.

With Karbon, you can automate reminders, setup workflows, and ensure that there is visibility on the scope of a project for each team member.

Calendly | Quick meeting scheduling

With a remote team or clients who span multiple time zones, it can be such a simplifier to use a scheduling service. Save yourself the endless “reply-alls” and mishaps over who is on what time zone and invest in a service like Calendly for booking appointments. Calendly updates your availability in real time so you can rest assured that you will never double book a meeting. It comes with features like custom reminder emails, cancellation notices, and calendar syncing. The free version works fine for most people though it is branded with “calendly” and you only have one meeting type as an option.

Google Drive | Easy & sharable access to information

We can’t stress enough the importance of real time editing and updating of shared documents. Avoid sending various versions back and forth with Google Docs robust variety of cloud-hosted documents and spreadsheets. We especially love the Google Sheets features for collaboration around ideas, updating contacts, and sharing live content. We’ve been able to connect Google Sheet directly with Quickbooks Online to automatically pull key financial metrics directly into various meeting agendas which has been extremely valuable when reviewing our company performance as leaders on a weekly basis. You can review our meeting agenda template here!

Fathom | Monthly Metric Review

Fathom is a reporting app that is especially focused on turning complex financial reports into beautiful, easy to read trends, Fathom connects easily to QBO, and it presents financial information in an easy, understandable way. Fathom puts accounting info into a visual, easier to understand form that is especially helpful for anyone who may not be especially numbers-minded. Really, it is a communication tool as much as a financial tool.You want your numbers to communicate the story of what is happening in your business and be able to present this data to your key stakeholders (team members, investors, or your spouse).

Loom | Video Teaching Tool

Loom is a great tool to create a tutorial by sharing your screen and recording the session to send via URL. If you need to shoot off a quick explanation about how to use a feature, or want to show a client an element of a program or website, you can record a short video for them. This allows the information to be reviewed at someone’s convenience.. And if your client or colleague has to pause to go homeschool their third grader, then they can always come back to it later!

While the focus of this post is the tools we use while working remotely, the theme is communication. This is particularly essential when you aren’t just down the hall from someone, but you still need to be able to communicate quickly and clearly. We want to make sure that the tools we do use are easy to use, intuitive, secure, and allow for quick and helpful communication.

by Chris Williams | Oct 6, 2020 | Blog, Bookkeeping Best Practices

Making the Jump from Solo-Practitioner to Forming a Group Practice

How do you know when it’s time to make the jump to forming a group practice? Many practitioners are impeded by not knowing where to start or wondering if the administrative time and the payroll cost might outweigh the profit. We’ve seen many MHPs (mental health professionals) make that switch successfully by identifying and utilizing apps that are designed to get you there. Before we explain the combination of knowledge and technology required to make this plunge, let’s take a look at some of the factors that you might be weighing as you consider expanding from solo counseling to a group practice.

Why would you do it?

- You’re overbooked! Clients love you and even though you may not have actually fully branded yourself, whatever you are doing is working. Instead of feeling overworked and stressed, spend some time figuring out what that secret sauce is that clients love about the way you do therapy. Hire like-minded professionals you can work with who can provide the bandwidth to add more clients to your practice without you bearing the brunt of those added hours.

- You acquire the opportunity to spread out your overhead costs. There are many therapists who would love to support an existing client base and be relieved of their own need to market, brand, and the accounting and admin that comes with a solo-practice. Make sure you hire the right people because you, as the business owner, are telling your clients that you’ve personally vetted this new therapist.

- You offer or specialize in one kind of counseling. Perhaps you only treat individuals but you keep getting asked by your clients if you can do couples counseling or counseling for kids. Rather than turning them away because you know it’s not your niche, you can add a therapist with those strengths and specialties to your practice without having to refer potential patients out.

To start a group practice the first order of business is to make sure you’ve identified WHY. Is it because you have a good brand that people like and you’re overbooked? Or do you intentionally want to expand? Do you want to diversify your offerings? Do you thrive in a collaborative environment? Knowing your motivation is important and will point you in the right direction for expansion, branding, communications, and networking.

Form the Correct Type of Entity

If you have a solo-practice, hopefully you’ve already taken advantage of the tax benefit of forming an LLC (in some states a PLLC), obtaining an EIN, placing yourself on payroll, and have considered filing as an S-Corp with the IRS. A stellar small-business focused CPA can walk you through the steps and explain to you the tax benefits of filing as an S-Corp.

If you’ve found another therapist who you are going into business with, form a new multi-member LLC (again, this is a great time to consult with a knowledgeable CPA so both owners can make sure they’re minimizing personal taxes) with a new EIN. Don’t let these details overwhelm you! There are plenty of CPA’s who can help you take these steps (we as accountants know quite a few).

Tracking Everything – The Apps

As a business owner, be sure to track everything! There are many practical tools that you can use to keep your finger on the details of your practice. Do your research and choose one piece of software that will handle almost everything an MHP will need to do with clients (scheduling, insurance billing, remote sessions, electronic paperwork, accepting payments, etc). A few that we’ve worked with are ChARM (https://www.charmhealth.com/) and Simple Practice (www.simplepractice.com).

Many of these can connect with an accounting software (Quickbooks Online is our go-to) for income recording. Most also have excel reports that can be exported to do a deep dive into reviewing margins and average billing numbers. Whatever it is you pick, you do need to ensure it can provide that all-important income reporting so that an accountant can take that info and integrate it into the accounting software where all expenses live.

A great accountant can help you build out basic margins tracking based upon billable sessions and pay rates for employees. Whatever you build should be scalable so that what works for 3 people can work for 10. No need to go fancy on margins reporting, Google Sheets is usually sufficient and it can be connected to QBO as well for automatic updating of your numbers. We often rely upon our own internal data specialist to build automatic reports like this for our clients; and though it requires expertise outside of the realm of normal spreadsheeting to build, once it is built, it can be easily run and refreshed as needed. The same holds true for calculating what you can afford for overhead and owner pay once you understand your margins and standard expenses.

Hiring Employees – It’s the Group part of “Group Practice”!

The Taxes

Even if you already have an EIN and have been paying yourself via payroll, odds are you didn’t open up a state unemployment insurance account as business owners are exempt from these taxes (you can’t really fire yourself and legitimately claim unemployment). Most states have online applications that can be completed in 15 minutes and an unemployment account number obtained same-day or within 2 weeks. Make sure you’re also covered with workers compensation insurance (some states have state-sponsored programs, other states you will be required to purchase via private agencies). Once applied for and received, whatever your current payroll system is should be well prepared for you to add new hires into.

If you don’t already have payroll up and running, we would recommend Gusto as a great small-business friendly system that allows 100% online hiring and onboarding of employees. Gusto also has some great articles that can help to give direction on the various state payroll tax accounts you’ll need to apply for depending upon what state you are located in.

The People

To hire good people you need to have a good employment proposition. A large portion of that is going to depend upon how you communicate what you’ll be offering in terms of compensation. There are two fairly common approaches but both are based around fees per session and how much gross profit you need to be left with to pay overhead and to pay yourself (and potentially any other owner).

- Pay a percentage of each session – In this scenario, you hire therapists and tell them their pay will be x amount of the fees they bring in during the month (say a 60/40 split or a 70/30 split). This is a guaranteed way to make sure you can always cover that employee’s salary as they’re only being paid for what they bring in. However, you want to be sure that the balance covers your own overhead such as rent, utilities and other professional fees (like accounting!).

- Pay a base wage and then create a variable compensation structure for fees brought in over that base wage – Guaranteeing you’ll cover everyone’s base salary with this method is a little more risky, but it is a more attractive employment proposition as employees see a direct correlation between more client sessions brings exponentially more pay. In this scenario and as an example you’d offer a base salary at the state minimum for professional positions at $24k. If a billable session is $100, you know they’ll need to have at minimum 20 sessions a month to cover just their salary. Any sessions in excess of those needed to cover payroll go toward paying overhead expenses. Since 20 sessions is considered to be a very low caseload, you can make the minimum 35 or 40 sessions a month and pay a portion of those revenue earnings out as additional compensation (i.e. you get 80% of the session fee for any session booked in excess of your established minimum, or even up to 90% if you book over 60 a month).

While it might seem small, additional perks are a great way to make an employment offer more desirable. Healthcare is always an option to add for full-time employees. As a small group employer you can usually pick a percentage of the monthly premium to cover and then have the rest deducted pre-tax from employee paychecks. An annual continuing education stipend is also attractive ($300 a year) along with additional pay for any time spent team-building or aligning everyone with your brand. Free supervision for those working towards full licensure is also a great addition that doesn’t take up much of your time as an owner, and also gives you an opportunity to train that person on the brand you’re building to pull more clients into the practice.

In Conclusion

At the end of the day your practice won’t grow steadily unless you hire the right people who will support your goals and work well with your clients. Take time to interview thoroughly and have a great employment proposition that provides for increased pay and growth opportunities in the future. Above all, make sure you’re hiring people who concur with your mission, vision and values. And finally, when you research, locate, and utilize the tools that will help you minimize time spent on administrative and accounting tasks, you and your team can focus on that which is the most important element of your successful practice; your patients.

by Dev | Sep 24, 2020 | Blog, Leadership

So often, meetings can seem like nothing more than necessary evils or giant rocks weighing you down, stopping you from actually getting work done. This can be especially true if you are a team leader in your organization. It can often feel like you do nothing but jump from meeting to meeting and if the scheduled ones aren’t bad enough, there are always impromptu or last minute ones that pop up as well. How in the world can you possibly find time to accomplish anything? For the past 18 months, we here at System Six have been using a meeting cadence that has alleviated most of these pitfalls – and we want to share it with you!

Agendas Matter

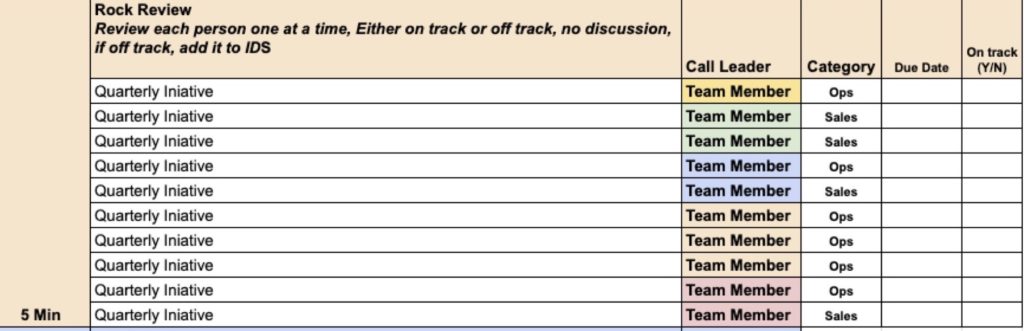

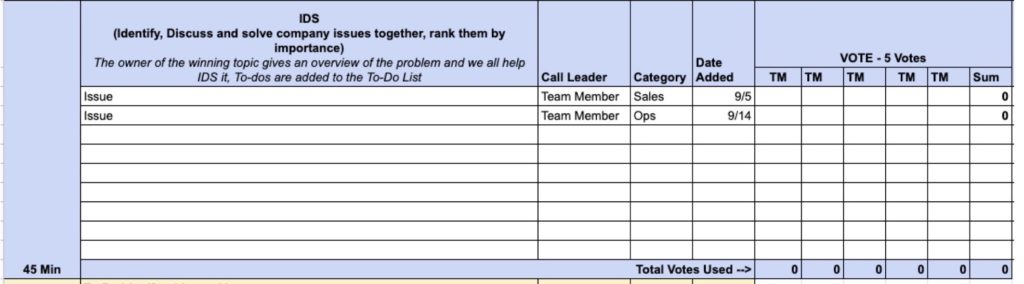

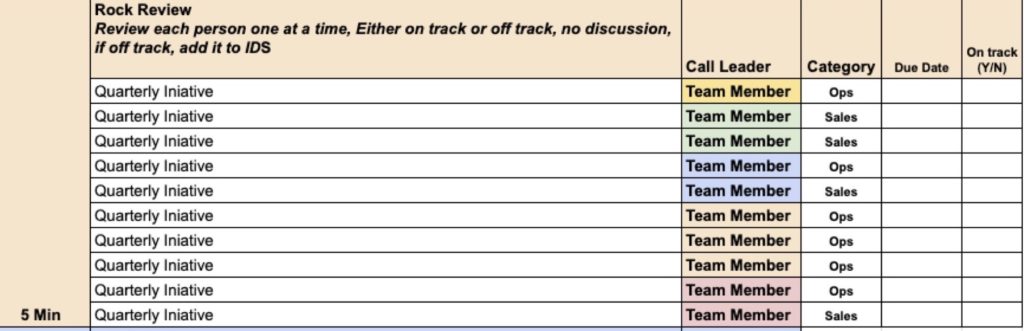

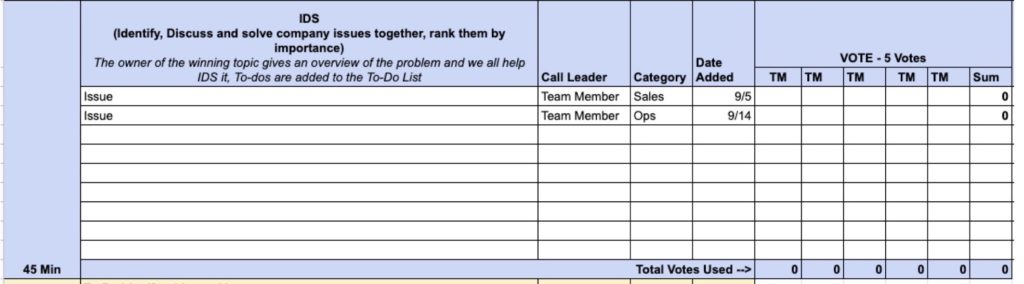

We created a team meeting agenda that we stick to which allows us to work through company updates and issues together as a leadership team while not detracting from the other things we are working on. It helps us keep one another accountable, and also leads to far fewer rabbit trails as we go through the meeting agenda which in turn buys us more time. This meeting agenda,pictured below, is mostly based on EOS (Entrepreneurial Operating System) and a book called Traction. We added a personal check-in sales scoreboard, client headlines, and team headlines but we give all the credit to the book and EOS model for helping us design this google sheet. (Click to see the spreadsheet up close – if you want a FREE COPY of this Leadership Meeting Agenda, just click here!)

A Look into Our Meeting Structure

Meeting Management

We use this agenda for our Monday leadership call and the attendees represent each department of the company (Sales, Operations, Finance, Culture, Customer Service). One person is designated as the “call leader” and is responsible for running the meeting and keeping everyone on track. If we don’t designate a manager for the meeting we can easily get lost in the weeds. The overarching goal is to bring everyone in the organization into the loop on what’s happening, where our progress stands, and what needs to happen next.

Maintain Relationship

For this meeting we always start with relational connection. For us it’s ten minutes, allowing us to connect on the highs and lows of life outside of work. With this knowledge we can support one another during busy seasons and it also reminds us all that we are people, not just performers.

Review your Key Performance Indicators

From there we move into our scorecard section which is five minutes of sales updates, landed contracts, goal statuses, leading and lagging indicators and operational hiccups that lead to lost revenue. This gives us space each week to get on the same page about how the business is functioning in its quantitative elements. The scorecard section usually stirs some good conversation topics that we add to our IDS section below.

Know Your Big “Rocks”

After that we go into one of the main parts of the meeting which we call Rock Review. Here we check on our large quarterly goals which we call our “big rocks” (see, rocks don’t have to weigh you down!). Each team leader is responsible for 1-3 “rocks” per quarter, and this meeting is a weekly opportunity to check in, encourage and help one another with our big picture projects. These “big rocks” require our primary focus and attention so we allow ample time for this section. For each item we do a full review, check off completed tasks and tackle possible hiccups.

Headlines & Accountability

After the Rock Review we go on to further agenda items. We spend a short and sweet five minutes on client “headlines” where we update one another on how clients are doing and then do the same with team “headlines.” We move from there to our To-Do List from the previous week which is not only an accountability check, but also a chance to address any roadblocks team members may be facing with their To-Do’s.

Rather than spending time throughout the week notifying each other of headlines with either clients or team members, we all know that we have this standing weekly meeting where all of those topics will be discussed. This keeps the overall weekly “noise” level down and we can trust that there is time and space to discuss these things every five business days.

Identify, Discuss, Solve

What follows next is the main section of the meeting, IDS (Identify, Discuss, and Solve—credit Traction). For this portion of our time together—45 minutes—we bring up company issues and rank them by importance. To do this each team leader gets five votes and chooses which topics are highest priority for them. The items with the most votes go to the top of the list, those with the least are bumped down to the bottom. This way we are working on issues that are critical to the company as a whole, not to just one person’s portions. We get through as many elements on the list as possible knowing that the rest will carry over to the next meeting. Out of this IDS time comes our to-do list for the following week. Our team knows they will be checked on for these items in the next meeting so it is a good reminder of exactly what is on each of our plates going forward.

Always Improving

To finish we end with rating the meeting. Each team leader rates the meeting on a scale of 1-10 and if there is a 7 or lower, the call leader asks that person why they gave that particular rating. That team leader then has an opportunity to explain their rating and it is a chance for us all to hear that and improve the meeting for next time.

Once the meeting is done the call leader copies the agenda, pastes below and then clears the solved issues, clears off completed to-dos, moves to-dos from this week to last week and makes sure the agenda is prepared and “fresh” for the next week. A clean slate! Something we can all—and especially the next week’s call leader—be grateful for. Throughout the week leaders can add topics directly to the IDS section of this newly created agenda. So instead of blasting an email that says “Guys, we have an issue we need to discuss,” that person can put the issue on the agenda and know it will be covered during the next meeting.

Know Your Meeting “Why”

The main goal for this meeting and for sticking to the agenda so closely is communication and connection. We are able to stay in the loop with each other, with team members, with clients and with whether or not goals are being met. This meeting allows us to avoid having to do daily calls and makes a huge difference in being able to better keep everyone’s respective time budget. Having a predictable meeting template has been critical to our success. Not having clear guidelines for how a meeting will run or what should be included just leads to confusion, frustration, and miscommunication.

Don’t be afraid to get critical about how and why you meet! Hopefully with some strategy, your business can find a cadence for your own leadership meetings that will motivate your team to reach its full potential.

If you’d like a free copy of our Leadership Meeting Template, just click HERE!

by Chris Williams | Sep 16, 2020 | Blog, Bookkeeping Best Practices, Non-Profit

Welcome to part two of our three part series on bookkeeping and finance specific to churches. This second part of the series covers program spending, restricted funds, and taxes. If you haven’t read part one it covers SAAS tools and services, I recommend reading that first since this part of the series builds on what was covered in part one, and you can look forward to the final part about budgeting.

Here in part two we will cover the aspects of church bookkeeping that often get overlooked as churches grow and operations and activities become more complex.

Program Spending

As a church grows, various ministries and programs start to take shape that require expenses, and sometimes income, to be tracked separately. Good examples of this are kids ministry, worship, building/operations — things that would often be considered “departments,” or “business segments” in the for-profit world. One option is to simply create new accounts for them, which works most of the time. However, what happens when the church wants to see supplies used by the kids ministry and the worship band separately? What if there are other accounts (food supplies, small equipment, etc.) that need to be tracked separately as well?

As this complexity grows we recommend creating “Classes” (a Quickbooks term) for each of the ministries. Terms for this vary across the accounting world but it’s essentially a way to show each ministry or program as a distinct column on the income statement. That way, it’s easier to see the goldfish crackers consumed (and sometimes inhaled) by the kids ministry separately from the muffins and croissants bought for the worship band’s Sunday breakfast.

The word of caution here is to only create “classes” for ministries where this type of separation is needed. It’s okay for other programs to exist as only an account since it’s easier to read an income statement containing three columns versus ten columns. As outsourced bookkeepers and solutions providers, this is a great opportunity for us to advise on what works best for each church’s specific needs and goals.

Restricted Funds

Most bookkeepers cringe when they hear the term “restricted funds,” and for good reason. In accounting this prompts potentially bitter memories of releasing expenses, changes to net assets, and tracking restricted income. This is usually a fair reaction because it can quite literally cause a headache with the multitude of accounting rules that dictate these funds.

Fortunately, all these requirements are only needed if the church is regularly audited according to U.S. GAAP standards. Since most churches do not fall under these standards, the process can be simplified more than you might realize!

What are “restricted funds” exactly? As with every non-profit in the country, each donation is given with an intent on how that donation will be used and organizations are bound by that donor intent. However, if churches are clear on how donations will be spent, and create a “general fund” with clear language that it will be used for general church operations and ministries it can safely be assumed that donors understand and are providing donations for that purpose. For this reason it is important that these expectations are clearly displayed or stated.

Problems arise when a donor states they would like their donation to be spent on a more specific purpose (i.e. choir robes, kids ministry, sprinkler repair, etc.). If the donation is accepted, then the donation is legally restricted to be used for that purpose. In most cases a quick conversation with the donor can convince them to change their designation to the general fund, but if not, that donation is now restricted and has to be tracked that way in the books.

It’s also perfectly normal for churches to intentionally set up a restricted fund especially if they need to raise funds for a special purpose. The most common example is a building fund set up to pay for a new roof or replace a furnace. This is most often associated with a special giving drive.

Whatever the case, the church needs to easily demonstrate two things in the books:

- How much money was collected for this purpose?

- How much money has been spent for this purpose?

Going back to the first section in this article the most effective way to answer these two questions is to set up a Class for the fund, especially if the expenses need to go to multiple accounts on the income statement. For almost all churches, using Classes will ensure that the expenses and income for the specific purpose are not mixed in with other general church giving and expenses and those two questions can be easily answered.

Taxes

I often hear the phrase “churches don’t pay taxes,” and while this is generally true there are some exceptions. These exceptions appear when churches start to engage in activities more commonly associated with for-profit companies. Here is a quick list of the more common exceptions:

- Selling books or merchandise

- Hosting a concert with paid public admission

- Collecting royalties for published content

- Receiving rent for parking lot spaces

- Fee income for a church-operated daycare

The term for these activities is “unrelated business income,” meaning they are unrelated to the normal operations of a church. All churches are required to fill out a 990 form to the IRS every year, but if they collect business-type income they are required to fill out a 990T form.

It’s important to note that just like with for-profit business some expenses related to these activities can be deducted against the income received, so it may be worth tracking the associated income and expenses using Classes, as mentioned above. Also, these types of income may be taxable to state government agencies. As outsourced bookkeepers it is important to be aware of all the income our church clients are receiving, and be able to advise them on if they are liable to pay taxes on some of their activities even if we are not the ones actually preparing the tax filings.

Final Thoughts

Currently, churches are coming under more and more scrutiny as we diversify our traditional institutions and as they change the scope and variety of ministries and services they offer. Because of this, it is important that churches stay under compliance with all tax and business laws. Keeping a clean set of books where it is easy to demonstrate how money is spent is crucial to building a healthy church.

It may seem complex to answer the many questions about how money is spent, but this process can be simplified immensely by working within the structure of a well thought out and organized budget. With clear, well formatted intentions, categories, and processes for delegating funds the process for reporting them only gets easier! Stop by next week for the final part of the series on church bookkeeping — budgeting!

by Chris Williams | Sep 2, 2020 | Blog, Bookkeeping Tech, Non-Profit

Oftentimes church bookkeeping can be a lot more difficult than for-profit bookkeeping due to the extra regulatory requirements placed on churches by the IRS and state government. We understand that these nuances can be incredibly difficult to navigate. As outsourced bookkeepers, it is our job to be experts on how to address the unique challenges of churches, and advise them on how to address those challenges in the most streamlined and efficient way possible.

We want to help relieve the sense of complexity with a three part series on bookkeeping and finance specific to churches. The three topics you can look forward to learning more about are:

Part 1 – SAAS Tools and Services

Part 2 – Program Spending, Restricted Funds, and Taxes

Part 3 – Budgeting

Let’s begin the first part of this series by taking a close look at the tools required for accurate and efficient church bookkeeping.

SAAS (software-as-a-service) Tools and Services

System Six believes that “outsourced” and “cloud bookkeeping” are dependent on each other. Even more than before, it is crucial that records and accounting be accessible no matter where people are working. Choosing cloud-based programs is not only convenient, but wise for security, availability, and quality of service for a much affordable price. Every recommendation is based on this premise.

Quickbooks Online

The first decision is to select a good bookkeeping/accounting tool. In almost all situations, I recommend Quickbooks Online (QBO) for its integration potential with other SAAS (software-as-a-service) tools, and the ability to directly connect to the activity feed for most banks and credit card companies. If the books are currently stored on a complicated collection of Excel spreadsheets, it’s probable that there is only one person who can help troubleshoot the system if there is a problem. QBO allows for multiple user access, and in turn allows for separation of duties between different bookkeeping roles spread across in-house church staff and you as the outsourced bookkeeping solution. It supports a team approach to bookkeeping that allows openness, checks and balances, and transparency across accounts. At just $20-40 per month, the benefits of choosing a “one stop shop” tool are well worth the investment.

Donor Management System (or DMS)

Each year churches and non-profit organizations scramble to provide year end statements to their donors. While the IRS does not require end-of-year statements to be sent by non-profit organizations, what they do require is that any donor claiming a charitable deduction on their taxes must provide proof of their donation, and a “written acknowledgement” by the organization fulfills this requirement. Since many church/non-profit donors will likely ask for this “acknowledgement” early in the year when they are working through their taxes, it is smart for all churches to be proactive. It is more efficient to prepare and send all the statements at once, rather than generate a single statement in response to every email or phone call from a donor.

Most churches start out small, so it is tempting to track donor information as well as donations within QBO. However it is most beneficial to be able to provide a donor statement upon request at any given moment. While there are some workarounds in QBO, most DMS’ are equipped to easily generate such a statement.

Here are some additional features common to most donor management systems:

- Providing a login to every donor so that they can view their donation record online.

- Batch reports providing a breakout of amounts contributed to each church fund.

- Ability to upload a letter template (for example, a year-end letter from the pastor), and insert a total amount given to every fund, where specified, and then email from the system along with the donor statement.

- Built-in merchant account or integration with one where donors can pay using ACH/credit card, and those donations are automatically posted to their donor account.

Each of these features by themselves offer significant savings in both time and capacity for everyone involved! Here is a good starting list of systems that we most commonly work with:

If you are interested in additional merchant accounts that integrate with some of these systems:

At this point, you likely have a burning question running through your mind, and that is “if I am tracking donations in a separate system, how do I get that information into QBO?” Oftentimes churches will try to double up their records in QBO and DMS, but generally this is unnecessary.

All you really need from QBO is financial reports because the DMS is tracking donor data. In QBO, all you need to track is the amount deposited and the breakout of the income.

It’s worth noting that NeonCRM (listed above) actually has an integration with QBO that will batch the donations and create a deposit entry in QBO that matches both the credit card and bank deposits. If the church you are working with receives a lot of ongoing donations, this is a huge time saver!

Final Thoughts

It’s important to note the unique relationship between a church and it’s donors. Primarily, that almost all donors regularly attend that church, and can visibly see how the money is spent and the results of their contribution. At any time, it is smart for a church to be ready to answer financial questions from their regular attendees, and they need to have the tools in place to quickly and easily answer those questions. As outsourced bookkeepers, we are in a great position to advise and manage the tools and solutions that remove financial pain points for the churches we serve.

We understand that there are similar frustrations in regards to budgeting, taxes, and spending, so look forward to the next two parts of this series. Church bookkeeping can be complicated, but with help from dedicated experts, it doesn’t have to be.

by Chris Williams | Aug 27, 2020 | Blog, Bookkeeping Tech, Leadership

Earlier this year, one of our favorite payroll providers, Gusto, decided that  one of the best ways to continue to innovate its product was to build an advisory council composed of the experts who use it every day: their accounting partners. After invites and interviews, Gusto created its first Gusto People’s Advisory Council (GPAC) with an exclusive set of members to act as their panel of experts for product and service feedback. GPAC is meant to be heavily relied on as Gusto works on releasing platform updates for payroll, benefits, and HR.

one of the best ways to continue to innovate its product was to build an advisory council composed of the experts who use it every day: their accounting partners. After invites and interviews, Gusto created its first Gusto People’s Advisory Council (GPAC) with an exclusive set of members to act as their panel of experts for product and service feedback. GPAC is meant to be heavily relied on as Gusto works on releasing platform updates for payroll, benefits, and HR.

Forty firms are represented after the selection process and I am super excited to represent System Six alongside the various companies that are part of GPAC. There’s a wide variety of small and large firms from all areas of accounting, tax and finance. The Gusto team heading the program are super innovative, pose great questions and ideas, and desire to integrate our feedback on the Gusto product.

Representing People Well

The most recent update to Gusto was the release of their People Advisory Certification. Over the past year and with the advent of COVID, it’s become more and more apparent that payroll cannot be separated from other employment practices (What kind of benefits do you offer? What kind of benefits can you offer? What are the state-mandated sick leave laws? Are you required to offer PTO?). The People Advisory Certification is designed to train accountant-users how to utilize the HR features built into the Gusto software to better advise our clients through these and similar questions.

As always, we at System Six strive to represent and advocate for you at every turn. With ever-changing products and procedures, we aim to be on the edge of new developments. It’s our hope to be the first to bring you services that can support your business goals and systems. This partnership with Gusto will allow your concerns and input to be directly channeled to those who have the ability to make improvements. I can’t wait to see what changes will be made that will directly improve your user experience and am proud to represent System Six and our clients on this panel.

by Dev | Jul 3, 2020 | Blog, Bookkeeping Tech, Leadership

The team at System Six is celebrating with our founding partner, Jeremy Allen, who has recently been selected to serve a two year term on the Intuit Accountant Council!

“The Accountant Council features forward-thinking, tech-savvy accounting professionals from across the United States,” says Mindy King of Intuit Quickbooks.

Several hundred applications pour in each year for a spot on the committee whose members bring expert  insight, innovation, and strategy to product development and services for the company. Their wisdom and experience directly impacts the success of small businesses around the globe. Jeremy will be serving a two year term on the sixteen member council which meets both virtually and in-person at their Silicon Valley headquarters.

insight, innovation, and strategy to product development and services for the company. Their wisdom and experience directly impacts the success of small businesses around the globe. Jeremy will be serving a two year term on the sixteen member council which meets both virtually and in-person at their Silicon Valley headquarters.

We are so proud to have Jeremy representing System Six in such a prestigious capacity. We know that he will bring the same client-centered, service-oriented approach to the Council that he brings to his clients and team every day. Congrats, Jeremy!

For the full article from Intuit, click here.

one of the best ways to continue to innovate its product was to build an advisory council composed of the experts who use it every day: their accounting partners. After invites and interviews, Gusto created its first Gusto People’s Advisory Council (GPAC) with an exclusive set of members to act as their panel of experts for product and service feedback. GPAC is meant to be heavily relied on as Gusto works on releasing platform updates for payroll, benefits, and HR.

one of the best ways to continue to innovate its product was to build an advisory council composed of the experts who use it every day: their accounting partners. After invites and interviews, Gusto created its first Gusto People’s Advisory Council (GPAC) with an exclusive set of members to act as their panel of experts for product and service feedback. GPAC is meant to be heavily relied on as Gusto works on releasing platform updates for payroll, benefits, and HR. insight, innovation, and strategy to product development and services for the company. Their wisdom and experience directly impacts the success of small businesses around the globe. Jeremy will be serving a two year term on the sixteen member council which meets both virtually and in-person at their Silicon Valley headquarters.

insight, innovation, and strategy to product development and services for the company. Their wisdom and experience directly impacts the success of small businesses around the globe. Jeremy will be serving a two year term on the sixteen member council which meets both virtually and in-person at their Silicon Valley headquarters.